Introduction

Building strong credit is crucial for any business looking to grow and thrive. One powerful tool that many businesses use to establish and improve their credit profile is a Business Credit Builder. In this article, we’ll dive into the world of business credit building services and explore the benefits, FAQs, and more.

Benefits of Business Credit Builder

BUSINESS CREDIT BUILDER accounts offer a range of advantages for companies of all sizes. Some key benefits include:

1. Enhanced Financial Flexibility

By utilizing a BUSINESS CREDIT BUILDER program, companies can access additional funding options, such as business credit builder loans, that can help them weather financial ups and downs.

2. Improved Credit Score

Consistently using a business credit builder card and other credit-building services can boost a company’s credit score over time, opening up more opportunities for financing and favorable terms.

3. Establishing Credibility

Having a solid business credit profile through BUSINESS CREDIT BUILDER tradelines can enhance a company’s reputation with suppliers, lenders, and other partners, ultimately leading to better business relationships.

Detailed Explanation of business credit building services

BUSINESS CREDIT BUILDER companies provide a range of services designed to help businesses establish and strengthen their credit profiles. These services may include:

1. Credit Monitoring

Monitoring the company’s credit profile to identify any suspicious activities or errors that could impact its creditworthiness.

2. Credit Education

Offering resources and guidance to help business owners better understand how credit works and how to improve their credit scores.

3. Credit Building Strategies

Developing personalized strategies to help businesses build credit efficiently and effectively, such as using a business credit builder card responsibly and diversifying credit sources.

Frequently Asked Questions (FAQs)

1. What is a Business Credit Builder?

A Business Credit Builder is a service or program that helps businesses establish and improve their credit profiles through various strategies, such as accessing BUSINESS CREDIT BUILDER loans and using business credit builder cards.

2. How Can Business Credit Builder Services Benefit My Company?

Business credit building services can benefit your company by enhancing financial flexibility, improving credit scores, and establishing credibility with business partners.

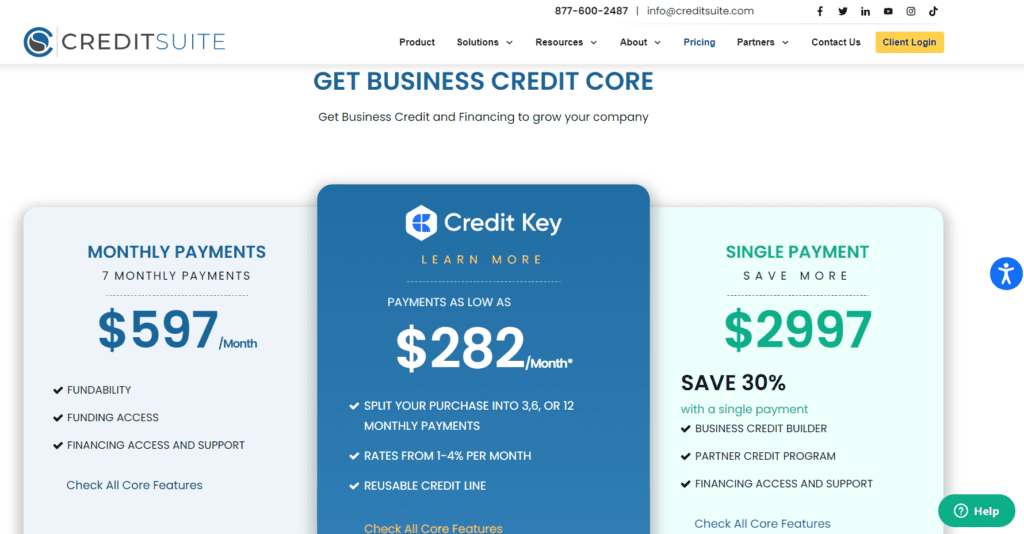

3. Are Business Credit Builders Worth the Investment?

For many businesses, investing in a Business Credit Builder is a smart move that can pay off in the form of better financing options and stronger business relationships.

4. Can I Build Business Credit on My Own Without a BUSINESS CREDIT BUILDER?

While it’s possible to build business credit on your own, using specialized services from business credit builder companies can expedite the process and help you avoid common pitfalls.

5. How Do I Choose the Right Business Credit Builder?

When selecting a business credit builder, consider factors such as the company’s reputation, the specific services they offer, and whether they cater to businesses of your size and industry.

Conclusion

Business Credit Builder services play a crucial role in helping businesses establish strong credit profiles and unlock new opportunities for growth and success. By leveraging the services and tools offered by business credit builders, companies can navigate the complex world of credit with confidence and achieve their financial goals.